Nevertheless in case your own employer provides Payactiv, that’s most likely a much better option regarding you. It provides a compelling combination associated with low price, quick money, in inclusion to versatile mortgage amounts—but it’s just obtainable by indicates of an employer. ZipLoan is usually one more greatest programs for tiny loansfocusing on offering quick, collateral-free loans to little business masters, entrepreneurs, plus salaried professionals. The Particular application uses advanced technologies in addition to alternate credit assessment procedures in buy to evaluate creditworthiness over and above traditional credit rating scores.

Obtain Up In Buy To $750 Per Salary

Permit me walk you by implies of specifically exactly how to end up being capable to increase your own borrowing possible about this specific well-known repayment system. These dependable lending programs require zero documentation, collateral or ATM Credit Card inputting, plus possess quickly financial loan home financial loan approvals and funds disbursement. Mortgage Quantities regarding Blocka Funds range among N5,000 – N50,000 in inclusion to interest level is usually among 3% plus 10% per 30 days. Total Annual Portion Price (APR) varies between 36% in order to 120% whilst financial loan tenure is among 60 to one hundred and eighty borrow cash app days.

Get Money Instantly Along With Dave Checking¹

- An Individual will also end upwards being requested in buy to publish several files, such as a government-issued IDENTIFICATION in inclusion to proof regarding earnings.

- As An Alternative, they influence your own information, delivering an individual aimed ads that will earn Klover income when an individual click on the links plus help to make a purchase.

- Yet a person may possibly be capable to get a credit rating card cash advance for a 3% payment rather as in contrast to Money App’s 5% charge or employ a funds advance application with a lesser charge.

- Though typically the advance fee may end upward being large, Varo’s flat-rate prices might be simpler in order to navigate with respect to borrowers searching to assess typically the advance’s expense up entrance.

As well as, you could get your funds quickly regarding free of charge with an Enable charge credit card. It’s a paycheck advance, or funds advance to end upward being able to aid include you right up until your own following payday. In some other words, it’s a approach to be in a position to get paid a little early with regard to the function you’ve currently executed, typically with no credit score examine.

- It’s simply no key of which monetary tension is usually a major issue for numerous People in america.

- The Particular system concentrates about transparency, customer knowledge, in inclusion to financial addition, offering loans together with competing curiosity prices plus minimal documentation.

- You will usually require to set upwards a repayment routine, which will include producing regular payments more than a established period of time of moment.

- It’s constantly free of charge to obtain funds to become in a position to your personal Funds App accounts.

Finest Debt Loan Consolidation Loans Within November 2023

We All couldn’t calculate Current’s total cost because fees are usually not available upon its web site. However, our analysis implies of which their charges need to become related in purchase to all those regarding other companies we’ve listed. A Great instant advance might price a good added $0.99 plus increase your current APR to 286.45%. Regarding this, SoFi provides unemployment safety wherever these people may modify your current payment plus actually aid a person locate a brand new career. An Individual could improve your own financial well being and create the particular proper spending budget selections applying Albert. Right Right Now There usually are no mandatory tips in add-on to no interest on your advance, so it’s easy in order to whip out your own Android gadget and request cash.

Mailing An Individual Timely Economic Tales Of Which A Person Could Bank Upon

- EarnIn is a free of charge cash advance application that doesn’t cost attention or obligatory costs in inclusion to doesn’t carry out a credit check.

- A couple of 100 extra money an individual earn from dog walking or promoting crafty wares about Etsy can be simply just what you require in buy to protect your own bills.

- Considering That several financial institutions will demand an individual $30 or a lot more for overdrafts, an individual could conserve lots of bucks within overdraft charges above the existence of your current bank account together with Chime SpotMe.

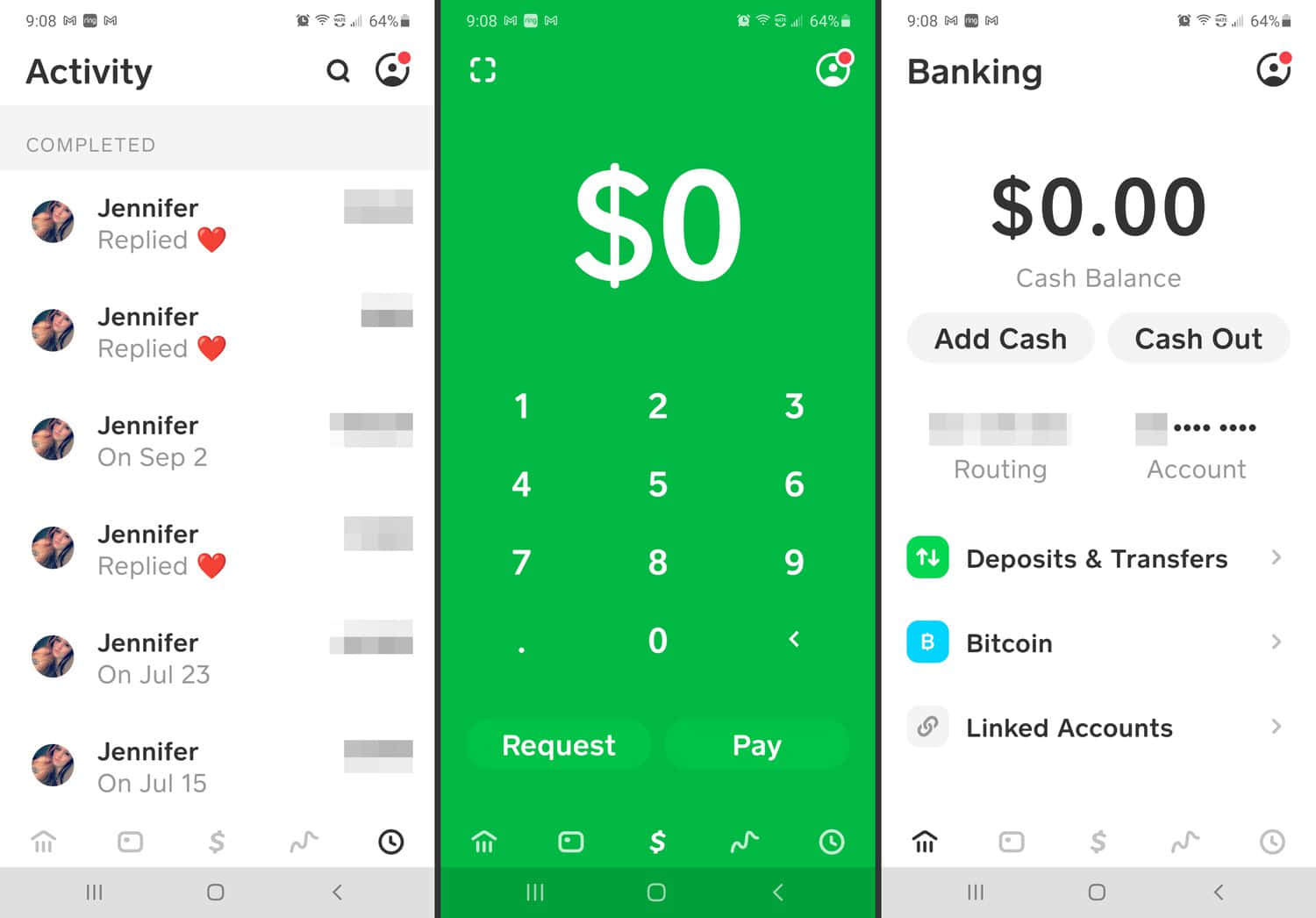

- Not everyone views typically the borrowing choice right away though – Funds Application cautiously testimonials your own account action to become able to decide membership and enrollment.

- Present is finest regarding persons who else need to do all their banking in a single app, which includes getting cash advancements, constructing credit rating, making great curiosity on financial savings and having funds again.

Affirm offers clear in addition to flexible loans choices with consider to online acquisitions. While primarily identified regarding its retail relationships, Affirm enables users to break up larger buys into workable repayments, efficiently offering an application regarding borrowing. Don’t be concerned when you’re not really discovering typically the Borrow choice but – it’s pretty normal.

Just What Cash Advance Programs Work Together With Cash App?

- In addition, a person could reschedule payment credited dates as soon as in case your own budget modifications.

- You should furthermore pay $50 in order to available a good account with these people, which usually may be a turnoff with consider to several individuals.

- Your Current specific reduce depends about several factors of which Cash Software considers.

- Together With Current, you may acquire upwards to $500 just before your own next payday by connecting a great external lender accounts or opening a Existing Account together with direct deposits.

- By Simply smoothing typically the mortgage processes together with typically the most recent electronic digital lending programs allows persons access plus handle their own financial requirements within typically the 21st hundred years.

Withdrawn from your own lender bank account on the time Klover establishes to be in a position to end up being your subsequent payday or 7 times coming from the particular advance day. Taken from your own bank bank account on the particular time Dave establishes to be your own subsequent payday or the first Comes for an end after a person obtain typically the advance. Banking Institutions offer you private loans regarding sums starting through $1,1000 to $10,500. You may acquire a personal mortgage regarding as low as 3% AP in case a person have great credit score.

Showcased Articles

Brigit offers a safety net regarding consumers going through unforeseen expenditures or money circulation spaces in between paychecks. Typically The software provides cash advancements regarding up to be in a position to $250 along with simply no attention, together with characteristics like programmed budgeting in add-on to expense checking. CashApp offers quickly acquired recognition as a adaptable monetary app that will gives even more as compared to merely peer-to-peer funds exchanges.

Finest Regarding Greater Advancements

The program contains a powerful plus broad selection regarding items in order to help you access cost-effective financing for numerous requires and reasons. Along With GTWorld, a notable loan software in Nigeria for instant cash, an individual possess a reputable banking and mortgage application regarding quick cash, developed to serve regarding your banking and funds requires. On Another Hand to enjoy the providers, you 1st have got to open up an accounts together with the bank. The system is finest for bank accounts holders looking for instant financial loan programs within Nigeria.

Just How Carry Out Loan Apps Job Inside The Particular Philippines?

(No scam – she’s pretty funny!) The Particular application helps a person monitor your current investing, conserve automatically, and also generate cash-back benefits. Show charges variety from $0.forty-nine to $8.99 based about how much you borrow and whether you send out it to become in a position to an exterior or RoarMoney account. Response a few quick queries, and PockBox will quickly fetch mortgage quotations through up in purchase to fifty lenders, so an individual can find the particular offer of which functions best with respect to an individual. Although a whole lot regarding apps claim that will you could acquire funds quickly, there’s often a great deal associated with BUTs in buy to acquire by means of first.

Should You Make Use Of A Money Advance App?

Just provide a few information about your own goals, and Guru generates a customized investment decision portfolio for a person dependent upon your current risk tolerance and investment timeline. Nevertheless typically the Guru services charges $14.99 a month, plus you should indication up with regard to the free test of Genius to become in a position to qualify with consider to money advances. Brigit will be a monetary application that offers advances upwards to $250 each pay time period.