A few leading accounting software services also provide tools for tracking inventory, creating purchase orders and more. To assist you in identifying the right accounting software service for your e-commerce business, we examined dozens of options. Our top selections are determined by factors that are important to e-commerce businesses, including third-party integrations, price, invoicing capabilities and inventory management. Notable features NetSuite’s accounting software offers include automations, domestic and global tax management tools, a comprehensive payment management solution and NetSuite product integrations.

Comprehensive reports

However, once I became more familiar with the software’s layout, completing tasks required no learning curve, even when setting up advanced actions such as automations. For example, to add a new project, I clicked “time tracking” on the left-hand menu, then the “projects” submenu item. From there, I could click “+New Project” at the top of the resulting screen and fill out a simple form to add my new project. The break even point, or BEP, is when the company’s revenues and expenses are equal during a particular accounting period. Ecommerce businesses should calculate the BEP to know the minimum for the production expenses.

Advantages of Cloud-Based Ecommerce Accounting Software

A free plan is available for businesses that earn up to $50,000 per year, with one user and one accountant. Cash accounting involves recognizing revenue and expenses when cash is exchanged, while accrual accounting recognizes revenue and expenses as they are incurred. E-commerce sales often fluctuate seasonally, so both cash accounting and accrual accounting can work well. Typically, e-commerce sellers start with the easier cash accounting method and then switch to the accrual method as their business grows in complexity.

Scalability and Integration Capabilities

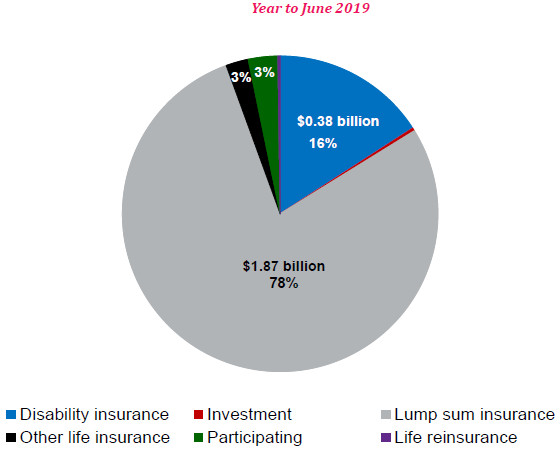

More importantly, the program should feature extensive data visualization options. From pie charts to bar graphs, users should have the freedom to manipulate the data however they see fit in order to get a clear picture of where their store stands. If you are an accountant, you will find Sage considerably easy to understand. In many cases, Sage seems like an application that’s geared more towards accountants instead of small business owners.

Customer Service

The fierce competition means business owners must take special note of their bookkeeping system, especially around tax season. That’s why developing the best bookkeeping practices can make all the difference. Remember, effective accounting journal entries in accounting: definition and how to guide is a key pillar of your ecommerce venture, so prioritize it alongside other crucial aspects of your business to ensure sustained profitability and growth. If the cash flow is positive, you have a financially healthy business.

Invoice Details

- With Sage Intacct, you can automate accounts payable, accounts receivable, general ledger and more to speed up your accounting work.

- I clicked “edit dashboard” and was given the means to deselect reports I didn’t want to appear on the dashboard.

- It offers two distinct operational modes—“Do-It-For-Me” and “I-Do-It-Myself”—allowing businesses to choose the level of control they wish to exert.

- Analytics and reporting capabilities are critical in any accounting software you choose.

- You can convert the quote and bill by a percentage of the original quote or a set quantity, rate or amount.

One of the most popular and well-known small business accounting tools available today is FreshBooks. Accounting rules and tax regulations differ by country and state, so staying up to date is crucial to your success. Even if accounting isn’t your strong point, there are a few simple guidelines to follow for managing a smooth ecommerce operation. This method gives a more accurate picture of a company’s financial situation, but it’s also more complex than cash basis accounting.

Small businesses may be able to find a less expensive basic plan, while larger businesses may need to upgrade to a more expensive standard or premium plan. All this to say, each step provided clear links or buttons to walk me through each subsequent step. Steps were intuitive to complete with simple forms, toggle buttons and drop-down options. At the top right-hand corner of the screen, a grid-like button with a hover-over label that read “add widget” sat. When I clicked on it, I was presented with a simple form to toggle on and off the widgets I wanted on the dashboard.

These reports should be easy to customize when it comes to date ranges and data inputs so you can be sure you’re looking at the information you need. If you run a large e-commerce operation, then you may benefit from Sage Intacct, cloud accounting software that’s designed for more complex operations. It includes not just accounting tools but also payroll and HR software to support a large business with multiple employees. Whether you’re navigating the complexities of an ecommerce enterprise or managing a different type of small business, top-notch bookkeeping is indispensable to ensure growth. High-caliber accounting software provides a clear and instant view of your business’s financial health, making your decision-making process significantly more straightforward. Wave accounting software lets you connect as many credit card and bank accounts as you want, making it much easier to keep track of all of your finances.

These insights include profitability ratios, cash positions, liabilities, fixed assets and taxes. NetSuite’s pricing is custom, so you’ll need to speak with a sales team member for a quote. To add to the software’s ease of use, templates make setting up automations intuitive. It’s impossible to overstate how crucial it is to collect and pay this tax for ecommerce companies. This money is not revenue but a sum a company owes to the government.

It offers cloud-based solutions, ensuring that businesses have access to their financial data wherever they are. Integrating financial management with inventory, HR, customer management and e-commerce, it consolidates disparate systems into one unified platform. By doing so, businesses can shift their focus from managing multiple software solutions to driving growth and innovation. This cohesive approach ensures that as business complexities arise, NetSuite can adapt, providing a foundation that supports not just accounting needs but a company’s holistic operational demands. It is designed for small business owners without an accounting background.

Each report has an action button embedded so you can complete relevant tasks. Once pressed, a drop-down menu offers common action items, such as adding an invoice or a bill. Simply click on the option to be taken to a page that walks you through the process to complete the task. Xero is one quickbooks payroll review of the most popular accounting software for small businesses, offering all the features you’d need. Beyond its core accounting capabilities, Xero offers an elevated experience for its record-keeping features. From there, you can easily retrieve documents to attach to invoices as necessary.

This adaptability extends to bank connections, integrating with over 9,600 financial institutions across the U.S. and Canada. This ensures that businesses have a singular view of their finances, with the ability to review, edit and reconcile records efficiently. Users say the platform is highly customizable while still being an out-of-the-box what is an expense management software solution. They also say that because the accounting software connects to other business solutions, it is a seamless solution across their companies. However, they say that using customizations requires a learning curve, and the price increases at each renewal, rendering the platform unaffordable for many small businesses in time.

The program itself is simple and easy to use, but we had to deduct some points because of its limited customer support options, particularly in the free plan. You can only access email support and live chat when you purchase a paid add-on (free users) or upgrade to the paid version. Many accounting software providers provide tools for tracking time spent on projects. Other useful features for e-commerce businesses include Sage’s invoicing capabilities, cash-flow-forecasting tools and Stripe integration for easy invoice payment. Sage also offers 24/7 customer support, and the software integrates with apps such as AutoEntry, Avalara and Credit Hound.

Tabs along the top of the accounting page also gave me access to my banking activity. I was prompted to connect my bank account, and at that point, instructions said the system would automatically import my bank transactions into the OneUp accounting solution. Xero is a good choice for small businesses that are looking for an accounting software with payroll capabilities. The software is also a good fit for businesses that are growing quickly and need to track projects and organize their documents efficiently. Intuit QuickBooks has a 4.3-star rating and a 4.4-star rating on Capterra and G2, respectively, with over 6,700 reviews on the two platforms. Users say the software is comprehensive in its accounting features and easy to use.

Companies like Intuit bundle their accounting services with other business software, so taking advantage of these deals could save you some money. Online guides (such as this one) can help you analyze and compare various options. Additionally, check user reviews and customer feedback on third-party review platforms and the Better Business Bureau website to get a well-rounded understanding. We found it easier and more intuitive to create invoices in FreshBooks than in the competing software we reviewed.

However, NetSuite earns a 4.1 rating on Capterra with 1,458 user reviews and a four out of five-star rating on G2 with 3,080 user reviews. I could star my favorite reports to add to my “favorite reports” list at the top of the page. When I clicked on a report, it was already populated with all my relevant data points. I only had to click the “send” button at the top of the page and specify an email recipient to share the report.

Ecommerce accounting will have different needs than other small businesses. There aren’t very many business owners who hope to remain at precisely the same size in the future as they are now. You want your company to be able to grow and you don’t want to have to worry about switching to new software when it does. You want a business accounting solution that offers you the functions you need at a price you can afford now and gives you room to grow down the road. If you are in the ecommerce business, one of the most important aspects of your accounting is sales tax compliance.

Our case study also reveals that Xero’s biggest weakness is limited customer support options—explaining its poor score in ease of use. The provider offers support only through email, a chatbot, and some self-help guides. Other providers like QuickBooks Online and Zoho Books offer phone support.

The best accounting software for ecommerce will automatically keep track of sales tax for each state, so you don’t have to worry about it. It allows you to complete various tasks, such as the ability to create and send invoices and accept payments from your smartphone. On the flip side, QuickBooks is less competitive in terms of pricing when compared to the other software on our list.